Small businesses in Australia have faced a rapidly changing environment in recent months. From rising interest rates to slacking consumer demand, business owners are some of the most affected players in the market and must look for ways to stay agile.

Small business restructuring allows companies to improve their bottom lines and get out of debt. But how does restructuring a small business work? Are there small businesses undergoing restructuring efforts?

This blog article explores the state of small business restructuring in 2024 and how it helps business owners remove debt.

What is small business restructuring?

Small business restructuring occurs when companies make operational and organisational changes. This can include transformations in staff, process efficiencies, and suppliers.

Typically, a small business that wishes to restructure will need to enter a restructuring plan with its creditors. On 1 January 2021, a new legislation by the Australian Government provided a simplified way for small businesses to restructure their debt. Under this new insolvency framework, the company directors can remain in control of their company and keep it operational instead of giving all control to a restructuring practitioner.

This flexible option was different from how insolvency was typically managed in Australia, where company directors had minimal to no control once they filed for insolvency.

Eligible small businesses can appoint a registered liquidator as their restructuring practitioner and enter a restructuring plan approved by creditors. In addition to preparing and managing the plan, the restructuring practitioner will oversee the company’s debt restructuring while its directors manage business operations.

Small business restructuring in 2024: What we know

Insolvency levels are said to peak in 2024, rising to the highest levels since the Global Financial Crisis in 2012. Insolvency rates are already 36% higher than pre-COVID levels, owing to hard-hit sectors like construction and hospitality.

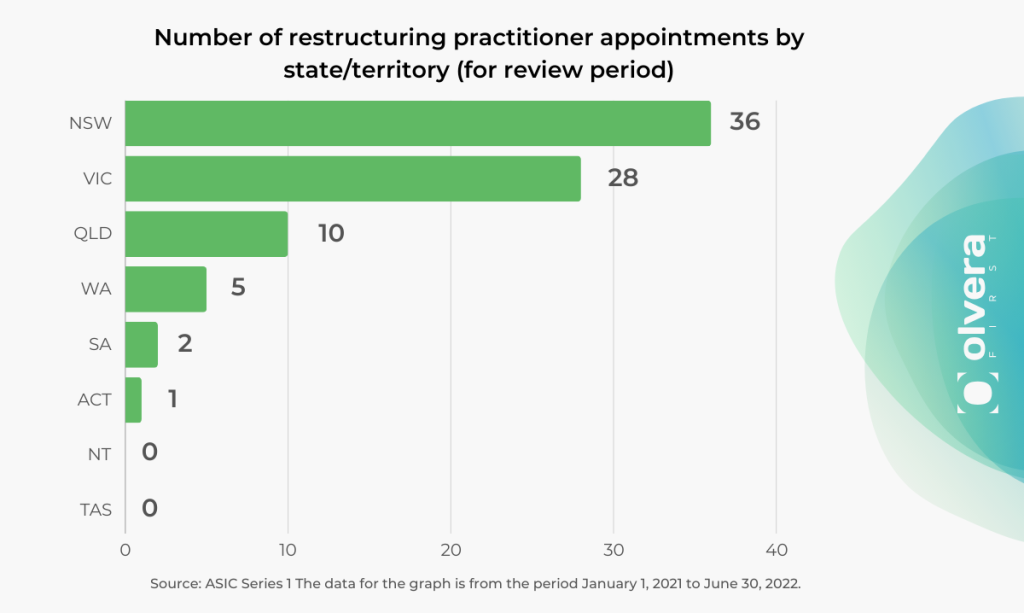

A report in January 2023 on small business restructuring from January 2021 to June 2022 claims that there were 82 restructuring practitioner appointments. Interestingly, New South Wales recorded the greatest number of appointments, followed by Victoria and Queensland.

Recent data from the ASIC shows that 8170 insolvency cases were recorded from July 2023 to February 2024, compared to only 6261 a year ago. The accommodation and food & service sectors recorded the highest jump in business insolvencies. If this trajectory continues, the total number of insolvencies will reach 10,782 by the end of the financial year.

The ATO is a big creditor for small businesses, as aggressive debt-chasing has put them under even more financial stress. Recently, the ATO announced it was cracking down on businesses with legacy debt, a debt that exceeds what could have been in relation to GDP and inflation conditions. In a statement, the tax office warned that it would report 100,000 to 150,000 businesses to credit reporting bureaus if their debts are unpaid by 30 June 2024.

The ATO can currently issue businesses penalty notices to claim any unpaid debts. We forecast that debt-chasing will be high on the tax office agenda for the remainder of 2024. With increased pressure from the ATO and interest rate hikes from the RBA, the small business restructuring process allows owners to relieve their debts and pay creditors.

The SBR Process

The SBR process is a simple one, aimed at removing traditional complexities for businesses in managing their debt. Here’s how a typical SBR process works:

- Step 1: The company director starts the process with a small business restructuring practitioner (SBPR).

- Step 2: The SBPR confirms the company’s eligibility to access the small business restructuring process.

- Step 3: The directors of the company officially appoint the SBPR in writing.

- Step 4: The SBPR, on behalf of the company directors, sends a letter to the company’s suppliers to notify that the restructuring process has commenced. The protection period for the small business begins, and a restructuring plan is developed.

- Step 5: The directors of the company prepare the restructuring plan with the assistance of the SBPR.

- Step 6: The restructuring plan is distributed to suppliers by the SBPR.

- Step 7: Suppliers have 15 business days to vote to accept or reject the restructuring plan. For the process to end successfully, the plan must be supported by more than 50% of suppliers.

When does a small business need to restructure?

Small businesses should consider restructuring when they are generally unable to pay their debts. Here are some other possible reasons a business might want to restructure:

- The business is acquiring losses.

- Struggling to pay off legacy debts.

- Facing cashflow difficulties.

- Have overdue taxes and lodgements from the ATO.

- Facing legal issues due to unpaid debt.

- Difficulty gaining access to new credit.

So, how does one get started with small business restructuring? Understanding the process is easier than you think.

Join Olvera Advisor’s SBR webinar

Learning how small business restructuring works is the first step to debt management and finding success in 2024. Olvera Advisors’ free online webinar offers critical insights for accountants, business owners, and professionals on all they need to know about the SBR process.

With an expert industry panel, the webinar covers SBR use cases, eligibility, and the legislation involved. Get started by clicking on the banner below for details and registration.

Olvera Advisors helps businesses stay ahead in a dynamic environment with bespoke restructuring solutions. Explore our blog for more insights on navigating the financial complexities of this dynamic industry.

References:

- What you need to know about small business restructuring

- Crippling debt: Insolvency ‘tsunami’ worst since GFC

- ASIC: Review of small business restructuring process

- Small business restructuring in Australia: Two years on, is the new process working as intended?

- Fears many Aussie businesses could collapse as ATO pursues legacy debts